Nigeria’s mobile revolution has unlocked unprecedented access to financial services, with a jungle of loan apps promising lightning-fast cash in your pocket. Among them, Lcredit burst onto the scene, alluring users with the siren song of “instant cash” and minimal fuss. But beyond the shiny facade, whispers of darkness have begun to rise.

Stories of exorbitant fees, exploitative terms, and relentless debt collection tactics are casting a shadow over Lcredit’s seemingly bright promise. In this article, we’ll venture deep into the loan app jungle, tracing Lcredit’s meteoric rise and exposing the predatory practices lurking beneath its surface. Through user experiences, expert insights, and a critical eye, we’ll illuminate the risks hidden within this “instant cash” mirage, equipping you with the knowledge to navigate this financial landscape safely and responsibly.

Join us as we peel back the layers of Lcredit’s operation, unraveling the truth behind the glittering app icon and empowering you to make informed choices in the face of alluring digital loans.

Who is Lcredit ?

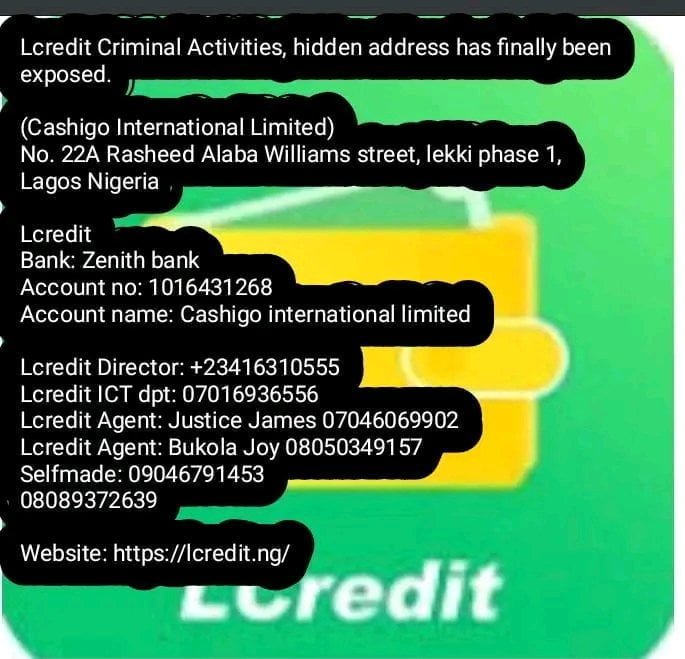

CASHIGO International Limited established the Lcredit Loan App to help individuals easily access secured loans without collateral or paperwork. Promising that it takes less than 5 minutes to get the money after approval from the company.

There are two licensed credit bureaus operating in Nigeria: CRC Credit Bureau Limited and CreditRegistry. These bureaus maintain records of individuals’ credit histories and provide reports to lenders. Lcredit itself doesn’t appear to be listed on any official registries of licensed lenders or credit bureaus in Nigeria. This doesn’t necessarily mean it’s illegitimate, but it’s something to be aware of.

Rise of Lcredit and the Lure of “Instant Cash”

Imagine this: you’re facing a sudden financial emergency, maybe a medical bill or urgent repair. Traditional banks seem like a distant, rigid land, and borrowing from family feels awkward. Then, you stumble upon Lcredit, a sleek app promising hassle-free loans in minutes, right on your phone.

Lcredit’s Rise to Prominence:

- Marketing Blitz: Lcredit didn’t shy away from attention. Slick social media ads featuring smiling Nigerians enjoying life after receiving “instant cash” flood platforms. Catchy jingles and celebrity endorsements amplified the message: financial freedom was just a tap away.

- Minimal Requirements: No tedious paperwork, no guarantors, just basic details and quick verification Lcredit made borrowing seem effortless. This resonated with Nigerians, particularly those excluded from traditional financial systems.

- Speed and Convenience: Download the app, fill in a few fields, and boom! Cash lands in your bank account within minutes. This lightning-fast process was Lcredit’s trump card, appealing to a tech-savvy, on-the-go generation.

Positive Echoes in the Early Days:

- App Store Reviews: Reviews from the initial Lcredit wave paint a picture of satisfied customers. “Lcredit saved the day when I needed money urgently,” exclaimed one user. Another praises the “quick and easy process.” These positive testimonials fueled Lcredit’s meteoric rise, further luring borrowers into its web.

- Financial Inclusion for All: For many Nigerians, Lcredit felt like a game-changer. It offered access to credit when traditional avenues remained closed. The immediate access to cash for small needs like groceries or school fees felt like a lifeline.

However, beneath the shiny surface of convenience lurked a darker reality. As we delve deeper, we’ll see how Lcredit’s seemingly attractive features transformed into ruthless practices, ensnaring users in a debt trap they could barely escape.

Behind the Mask: Exploitative Loan Terms and Predatory Practices

A. Unveiling the True Cost of “Instant Cash”:

They make many great promises, and they include the following:

- Customers can enjoy easy and quick access to funds ranging from N5,000 to N50,000.

- The interest rate is very low and competitive, and the maximum rate is 1% daily with an annual percentage rate of 36%–300%.

- There is a fast registration process.

- Customers enjoy support from excellent teams on the website, social media platforms, and app.

- You do not need to present a guarantor and collateral or complete paperwork to get loans.

Contrasting these advertised terms with the reality:

High Interest Rates: I decided to check their process to get first-hand experience before delving into online user reviews. Guess what I found? The process was smooth as promised, but Lcredit offered me 67,000 thousand Naira but disbursed 43,550 thousand Naira; the difference was withheld as a VIP fee. But it didn’t end there; I’m supposed to pay back 70,758 thousand Naira within a 7-day period.

Hidden Fees: Lcredit has different hidden charges; an example of these are their late payment penalties, which are not fixed nor are they calculated by percentage. They serve you what they feel is due. Another unfair hidden charge is the processing fees, which are visible in my investigation. Imagine paying a 5,520 processing fee for a loan of 12,000 Naira for a period of 7 days, only to repay 17,772.

Also Read: Loan Apps in Nigeria: Your 2024 Guide to Borrowing Smarter (and Safer)

Short Repayment Periods: The unrealistic 7-day repayment window creates immense pressure and increases the risk of default. Most people would rather not take a loan if they could get the money they need in 7 days. The 7-day repayment period happens to be a hook to hold people down, which will in turn increase their chances of increasing the overdue interest rates.

Case Studies: Victims of Lcredit’s Predatory Practices

In this section, we’ll showcase the real-life struggles of individuals impacted by Lcredit’s practices. Aim to highlight the emotional and financial toll while maintaining anonymity and respecting privacy. Consider incorporating the following points:

Case Study 1: The Struggling Mini-Business Woman:

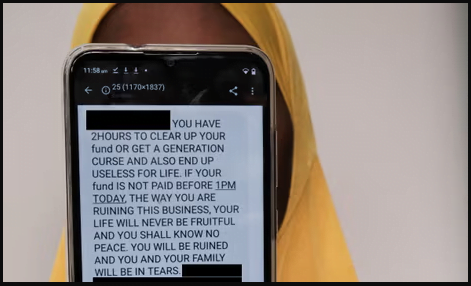

Jane (name changed for Privacy Reasons) “I have been going through a lot lately because of these loan apps, and I can’t stand it any more. I took a simple loan from Lcredit last year, and due to a family emergency, I could not pay them in full, so I paid half, thinking I would pay the other half later on. But the blackmail I got from them has been so much. Where I work, I call a lot of people and also have a lot of customer numbers on my line, and they have ruined me for them. I got laid off from work because of that. They told me they would send a message back to clear my name if I paid, and so I did but they didn’t do as they promised.

I have been doing some minor business to keep myself going, and for my siblings, I had no choice but to take loans from other loan apps to start up. After everything, I was selling, paying, and borrowing just to meet up. During October, my shop was looted, and I lost it all. The insults and calls I have been getting are just so much that I don’t know where to turn anymore.

Also Read: Who are the really Sharks behind these loan apps

I am so down mentally and emotionally, and I doubt my state of mind sometimes. I have no confidence in myself anymore. And the debt keeps increasing every day. I am tired of everything.

I was tired and tried ending it with some rat poison last week, but people ruined it by rushing me to the hospital.

I have no cash to start anything; how do I survive?

I just want it to stop, please I have no self confidence anymore.”

Case Study 2: The Student:

Let hear what a student that want to be addressed by the name Oluwafemi has to say about his encounter with Lcredit:

“Yesterday, Lcredit called my Dad and messaged some of my contacts. Last night the entire family called me on the phone around 11pm and I had to start explaining myself, it was as if they called a family meeting on top my matter.

Today those bastards still continued to threaten me with defamation. Normally I no dey reply their message but today I just decided to give it to them hot hot. I no send anyone again.” Lets see some screenshots.

The Unregulated Jungle: A Lack of Oversight and Accountability

Nigeria’s booming loan app market, while offering financial inclusion for many, operates in a regulatory grey area, leaving borrowers vulnerable to predatory practices like those employed by Lcredit. Unlike traditional banks, these apps often face minimal oversight, creating a fertile ground for exploitation.

A Regulatory Maze: The Central Bank of Nigeria (CBN) introduced guidelines for mobile money operators in 2012 and later updated them in 2020. However, these primarily address anti-money laundering and consumer protection against fraudulent activities, not loan terms or debt collection practices. The Securities and Exchange Commission (SEC) also issued regulations for crowdfunding platforms in 2020, but their applicability to loan apps remains unclear.

Falling through the cracks: This lack of clear regulations leaves borrowers with limited legal recourse. While the Consumer Protection Council (CPC) exists to address consumer complaints, its effectiveness against loan apps has been questioned. The sheer number of complaints and challenges in proving specific violations hinder swift action.

A Global Problem: Nigeria is not alone in facing this challenge. Predatory loan apps across developing economies have raised concerns from international organizations like the World Bank and the Financial Stability Board. Their reports highlight the need for harmonized global regulations and consumer protection frameworks for the digital financial services sector.

Calls for Change: Advocacy groups and financial experts in Nigeria are urging the CBN and SEC to collaborate and establish clear regulations for loan apps. These regulations should address issues like:

- Transparency in loan terms and fees: Full disclosure of interest rates, hidden charges, and late payment penalties is crucial.

- Responsible lending practices: Limits on interest rates, loan durations, and debt collection tactics are needed to prevent predatory practices.

- Data privacy and security: Strong data protection measures are essential to safeguarding borrowers’ personal information.

- Effective complaint redressal mechanisms: Streamlined grievance procedures and enforcement mechanisms are crucial for holding loan apps accountable.

The unregulated nature of this industry leaves millions of Nigerians exposed to financial risks. Without swift and decisive action from regulatory bodies, the “instant cash” dream offered by apps like Lcredit could quickly turn into a debt nightmare for many.

Navigating the Loan App Market: Tips for Safe Borrowing

The allure of instant cash can be tempting, especially when facing financial hurdles. However, before diving into the loan app jungle, remember: caution is key. While responsible loan apps can be helpful tools, predatory practices lurk in the shadows. Here are some crucial tips to ensure safe borrowing through loan apps:

1. Do Your Research: Never download an app based solely on online ads or promises. Research extensively! Read reviews, compare interest rates and fees across different apps, and consult trusted financial advisors or consumer protection agencies. Look for apps with transparent terms and conditions, clear communication channels, and positive user experiences.

2. Understand the Terms: Don’t rush into accepting loan offers without fully comprehending every detail. Scrutinize the Annual Percentage Rate (APR), hidden fees, penalties for late payments, and collection practices. Ask questions and clarify any doubts before hitting “accept.” Remember, if something seems too good to be true, it probably is.

3. Borrow Only What You Can Afford: Be realistic about your repayment capacity. Don’t borrow more than you can comfortably manage within the given timeframe. Avoid borrowing to repay another loan, as this traps you in a debt spiral. Create a budget and factor in loan repayments to ensure you won’t struggle financially later.

4. Protect Your Information: Be wary of apps requesting excessive personal information. Share only what’s necessary for the loan application. Never provide bank account details or sensitive data without absolute trust in the app’s security practices. Look for apps with strong encryption and data protection measures.

5. Explore Alternatives: Consider alternative financial solutions before resorting to loan apps. Explore personal loans from reputable banks, credit unions, or microfinance institutions. These may offer lower interest rates and clearer regulations. Exhaust all other options before turning to loan apps.

6. Report suspicious activity: If you encounter predatory practices, hidden fees, or aggressive collection tactics, report the app immediately. Contact regulatory authorities, consumer protection agencies, and app stores to raise awareness and hold the app accountable. You can also share your experience on review platforms to warn others.

Remember: Loan apps can be helpful tools, but borrowing responsibly is crucial. By following these tips, you can navigate the loan app maze safely and avoid falling victim to predatory practices. By educating yourself and making informed decisions, you can access financial solutions that empower you, not exploit you.

Additional Resources:

- Forward any info to any or all of these emails: lenderstaskforce@fccpc.gov.ng, info@nitda.gov.ng and cpd@cbn.gov.ng

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any financial decisions.

Conclusion: Calling for Change and Responsible Lending

The story of Lcredit serves as a stark reminder of the potential dangers lurking within the seemingly convenient world of instant loan apps. As we navigate this increasingly digitalized financial landscape, it’s crucial to acknowledge the systemic issues at play and demand change.

Firstly, stricter regulations and effective oversight are urgently needed. The current regulatory framework remains inadequate, allowing predatory practices to flourish. Independent bodies empowered to enforce fair lending standards and address borrower grievances are paramount.

Secondly, consumer awareness plays a vital role. Equipping Nigerians with the knowledge to critically evaluate loan terms, identify hidden fees, and understand their rights as borrowers is critical. Educational campaigns and financial literacy initiatives can empower individuals to make informed decisions and avoid falling victim to predatory tactics.

Finally, responsible lending practices must be adopted within the industry itself. Ethical lenders prioritize user well-being over profit maximization. Transparency in terms and conditions, fair interest rates, and responsible debt collection practices are essential to building trust and ensuring a sustainable financial ecosystem.

The rise of Lcredit and its exploitative practices should not be seen as an isolated incident. It represents a symptom of a larger problem that demands collective action. By advocating for stricter regulations, promoting financial literacy, and encouraging responsible lending practices, we can work towards a future where financial technology empowers Nigerians, not exploits them.

Together, we can create a loan app jungle where the grass is greener, not predatory.