Introduction to Loan Apps in Nigeria

In recent years, the economic landscape of Nigeria has witnessed significant transformations, driven by various factors including technological advancements and a growing demand for financial inclusivity. One notable development in this regard is the increasing popularity and necessity of loan apps. These digital platforms have emerged as a critical solution to the pressing need for quick and easy access to credit among Nigerians. Given the challenges associated with traditional banking services—such as lengthy loan approval processes, stringent eligibility criteria, and limited access in rural areas—loan apps have become a vital alternative.

Loan apps in Nigeria cater to a diverse range of financial needs, from personal loans and emergency funds to business capital and educational expenses. The primary allure of these apps lies in their convenience, speed, and accessibility. Unlike traditional banking institutions, loan apps streamline the borrowing process, enabling users to apply for and receive loans within minutes. This is particularly beneficial for individuals who may not have access to conventional banking services or those who require immediate financial assistance.

Furthermore, the best loan apps in Nigeria offer user-friendly interfaces, making it easy for individuals from various backgrounds to navigate and utilize their services. These apps typically require minimal documentation and provide a transparent overview of loan terms, interest rates, and repayment schedules. As a result, borrowers can make informed decisions without the bureaucratic red tape often associated with traditional loans.

Additionally, the digital nature of loan apps ensures that they are accessible to anyone with a smartphone and internet connection, significantly broadening financial inclusivity. This is particularly crucial in Nigeria, where a considerable portion of the population remains unbanked or underbanked. By leveraging technology, loan apps are bridging the gap between financial institutions and the masses, contributing to the overall economic growth and stability of the country.

In summary, the rise of loan apps in Nigeria is a testament to the evolving financial landscape and the increasing demand for flexible and accessible credit solutions. These apps not only offer a convenient and efficient alternative to traditional banking services but also play a pivotal role in enhancing financial inclusion and empowering individuals and businesses across the nation.

Criteria for Selecting the Best Loan Apps

When evaluating the best loan app in Nigeria, several crucial factors must be considered to ensure an optimal borrowing experience. These criteria not only safeguard the interests of the user but also enhance the overall efficiency and reliability of the loan process.

Interest Rates: One of the primary factors to consider is the interest rate offered by the loan app. Lower interest rates translate to lower overall repayment amounts, making the loan more affordable. Borrowers should compare rates across different apps to identify the most favorable terms. It’s also important to be aware of any hidden fees or charges that could impact the total cost of the loan.

Repayment Terms: Flexible repayment terms allow borrowers to choose a schedule that fits their financial situation. Whether it’s a short-term or long-term loan, the ability to select a suitable repayment period can greatly affect the borrower’s ability to repay the loan without financial strain. Look for apps that offer customizable repayment plans and grace periods if needed.

User Interface Experience: A user-friendly interface enhances the overall experience of using a loan app. An intuitive, easy-to-navigate app ensures that users can quickly apply for loans, track their repayment schedules, and access customer support. The best loan apps in Nigeria prioritize a seamless user experience to facilitate smooth transactions.

Customer Service: Reliable customer service is essential for addressing any issues or queries that may arise during the loan process. Top loan apps provide multiple channels of communication, including live chat, email, and phone support, ensuring users can get timely assistance when needed. Good customer service can significantly enhance user satisfaction and trust.

Security Features: Ensuring the security of personal and financial information is paramount. The best loan apps utilize advanced encryption technologies and adhere to strict data protection regulations to safeguard user data. Look for apps with clear privacy policies and robust security measures to prevent unauthorized access and fraud.

User Reviews: User reviews offer valuable insights into the real-world performance of loan apps. Reading reviews and testimonials can help potential borrowers understand the strengths and weaknesses of different apps from the perspective of other users. High ratings and positive feedback typically indicate a reliable and effective loan app.

By carefully considering these factors, users can make informed decisions and select a loan app that best meets their needs. This comprehensive approach ensures a secure, efficient, and satisfactory borrowing experience.

Top Loan Apps in Nigeria for 2024

In 2024, the financial landscape in Nigeria has seen significant advancements with numerous loan apps providing quick and accessible credit solutions. Here, we delve into the top-rated loan apps that have garnered attention for their reliability, user-friendly interfaces, and flexible loan terms.

1. Carbon – 1M+ app downloads

Carbon, formerly known as Paylater, stands out for its seamless application process and instant loan disbursement. Users can borrow up to ₦1,000,000 with interest rates ranging between 1.75% to 30%, depending on the loan tenure and amount. Carbon also offers additional financial services, such as bill payments and investment opportunities, making it a comprehensive financial tool.

2. FairMoney MFB – 10M+ app downloads

FairMoney is renowned for its quick loan approval, often within minutes. The loan app provides amounts up to ₦500,000 with interest rates starting at 10% monthly. FairMoney’s unique selling point is its flexible repayment options, allowing users to choose their repayment terms, which can be as short as one month or as long as 12 months. This flexibility makes it one of the best loan apps in Nigeria.

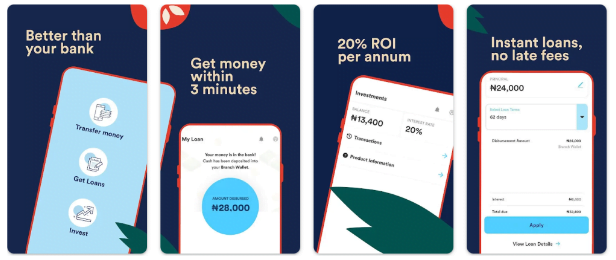

3. Branch – 10M+ app downloads

Branch has gained credibility for its transparent loan terms and fast processing times. Users can access loans ranging from ₦1,000 to ₦200,000, with interest rates between 15% to 34% depending on the loan duration. The app’s user-friendly interface and 24/7 customer support enhance the borrowing experience, ensuring reliable service.

4. PalmCredit – 5M+ app downloads

PalmCredit offers one of the highest loan amounts in the market, up to ₦300,000. The interest rates are competitive, ranging from 4% to 24%, with loan tenures from 14 days to 180 days. PalmCredit’s quick approval process and minimal documentation requirements make it a preferred choice for many Nigerians seeking immediate financial assistance.

5. Aella Credit – 1M+ app downloads

Aella Credit provides loans up to ₦1,000,000 with interest rates starting at 4% per month. The app is known for its robust security features and user-centric design. Additionally, Aella Credit offers financial management tools, helping users track their spending and manage their finances effectively.

In comparing these top loan apps, one can see that each has its unique strengths. Carbon and Aella Credit are ideal for larger loan amounts, while FairMoney and PalmCredit offer more flexibility in terms of repayment. Branch stands out for its transparency and support services. Choosing the best loan app in Nigeria ultimately depends on individual financial needs and preferences.

How to Safely Use Loan Apps and Avoid Scams

In today’s digital age, loan apps have become a convenient and efficient way to access financial assistance. However, to ensure you are using the best loan app in Nigeria without falling victim to scams, it is crucial to take certain precautions. First and foremost, always download loan apps from trusted sources such as the Google Play Store or Apple App Store. These platforms typically screen apps for malicious activity, providing an initial layer of security.

Before downloading any loan app, take the time to read user reviews and ratings. Genuine feedback from other users can offer invaluable insights into the app’s reliability and functionality. Pay close attention to recurring complaints or issues, as these may indicate potential red flags. Furthermore, thoroughly review the terms and conditions before applying for any loan. Understanding the interest rates, repayment terms, and any associated fees will help you make an informed decision.

Be wary of loan apps that request excessive personal information or upfront fees. Legitimate loan apps generally only require essential details such as your name, contact information, and bank details. If an app asks for sensitive information like your social security number or demands payment before processing your loan, it is likely a scam. Always prioritize your personal and financial information, ensuring it is kept secure and private.

Another critical aspect of safely using loan apps is recognizing red flags. For instance, apps that promise instant approval or unusually low-interest rates should be approached with caution. These offers often sound too good to be true and may be tactics to lure unsuspecting users into fraudulent schemes. Additionally, ensure that the app provides clear customer support channels, as reputable loan apps will always have accessible and responsive support teams.

By following these practical guidelines, you can confidently navigate the landscape of loan apps, safeguarding yourself from potential scams and fraudulent activities. Utilizing the best loan app in Nigeria responsibly will not only fulfill your financial needs but also ensure a secure and positive borrowing experience.

FAQs

How can I borrow from FairMoney

Borrowing from FairMoney is pretty easy and can be done in 3 steps. Simply download the app here, create an account and click “get loan”. FairMoney’s AI will check your loan eligibility and grant/deny your loan request.

How long does it take to get a loan in Nigeria

Timing varies depending on the platform chosen. With regards to getting a loan from FairMoney, It typically takes an average of 5 minutes.

Can I get a loan in Nigeria instantly?

Yes, you can. The apps listed above give instant online loans.

If you want to try FairMoney, download the FairMoney app from the Google Play Store. Sign up with the phone number linked to your BVN, answer a few questions and confirm your identity to receive a loan offer. If you accept it, you will receive your loan instantly in your preferred bank account!

What are the interest rates for loans in Nigeria?

Interest rates vary depending on the loan provider. FairMoney’s interest rates range from 2.5% to 30% depending on the amount you want and duration of the loan ie. the length of time for repayment.

Do instant loans need any collateral?

This depends on the loan provider. On the other hand, FairMoney instant loans require no collateral or documentation. Find more about our loan characteristics here.