Imagine this: You need a quick cash injection for an unexpected bill or a small business venture. Gone are the days of endless bank lines and mountains of paperwork. In Nigeria, a new wave of financial inclusion is sweeping the landscape, driven by a potent force: loan apps.

These digital marvels promise instant access to funds, blurring the lines between traditional banking and on-demand convenience. But with great power comes great responsibility. Navigating the ever-evolving world of loan apps can be daunting, especially in a fast-paced country like Nigeria.

That’s where this guide comes in. We’ll be your compass, steering you through the intricacies of borrowing with loan apps in 2024. We’ll equip you with the knowledge and tools to unlock smarter and safer borrowing practices, empowering you to make informed financial decisions in this dynamic digital era.

Whether you’re a seasoned loan app user or a curious newcomer, this guide is your one-stop shop for all things loan apps in Nigeria. Get ready to:

- Demystify the different types of loan apps and understand their unique offerings.

- Unravel the mysteries of loan eligibility and requirements, ensuring you meet the criteria for successful applications.

- Grasp the key terms and costs associated with borrowing, so you can compare apples to apples and choose the best deal.

- Develop smart borrowing habits that build your credit score and open doors to future financial opportunities.

- Stay vigilant against scams and fake apps, protecting your data and your hard-earned money.

So, buckle up and join us on this journey towards mastering the art of borrowing with loan apps in Nigeria. Remember, knowledge is power, and with the right guidance, you can harness the power of these financial tools to achieve your goals and build a brighter financial future.

Let’s dive in!

Understanding Loan Apps in Nigeria: Your Digital Lending Compass

Forget the dusty bank branches and tedious forms. In Nigeria, loan apps are revolutionizing how we access cash, offering a quicker, more convenient alternative to traditional lending. But before you download and tap “borrow,” let’s take a closer look at this dynamic landscape:

Types of Loan Apps:

- Payday Loans: Think emergency cash for those unexpected bumps in the road. Loans are typically smaller, with shorter repayment periods (think weeks or months) and higher interest rates. Perfect for covering urgent expenses like medical bills or car repairs.

- Long-Term Loans: Need a bigger chunk of change for bigger goals? These loans offer larger amounts and longer repayment terms (up to several years). Suitable for financing education, business ventures, or major purchases.

- Emergency Loans: Facing a Sudden Financial Squeeze? Emergency loans offer immediate access to small amounts, often with flexible repayment options. Think of them as a financial safety net for urgent needs.

- Investment Loans: Want to take your entrepreneurial dreams to the next level? Investment loans provide capital for business expansion or new ventures. Terms vary depending on the project and lender.

Loan Eligibility and Requirements:

- Basic Needs: Most loan apps require basic KYC (Know Your Customer) information like your BVN, bank statements, and proof of income.

- Creditworthiness Check: Apps assess your credit history and financial health to determine your eligibility and loan terms. A good credit score opens doors to better deals.

- Technology-driven: Get ready to embrace the digital! Many apps leverage facial recognition or alternative data sources to analyze your creditworthiness.

Loan Terms and Costs:

- Interest Rates: Understand the APR (Annual Percentage Rate), which reflects the true cost of the loan, including interest and fees. Compare across different apps to find the most competitive rates.

- Origination Fees: Some apps charge upfront fees for processing your loan application. Factor these costs into your calculations.

- Late Fees: Missing a payment? Brace yourself for late fees, which can quickly add up. Prioritize timely repayments to avoid them.

Now, with this foundation laid, you’re ready to delve deeper into choosing the right loan app, building good borrowing habits, and navigating the landscape safely. So, let’s embark on this journey together and unlock the full potential of loan apps in your financial game!

Borrowing Smarter with Loan Apps:

Gone are the days of scrambling for cash under the couch cushions or facing endless queues at the bank. In Nigeria, loan apps have emerged as a powerful tool for tackling unexpected expenses, investing in your future, and achieving your financial goals. But borrowing with savvy is key to navigating this fast-paced landscape and making the most of these digital marvels. Here’s your roadmap to smarter borrowing with loan apps:

1. Assess Your Needs and Borrow Wisely:

Before hitting that “borrow” button, take a deep breath and ask yourself: Is a loan truly necessary? Can you tap into savings or alternative solutions like a personal loan from a friend or family member? Remember, borrowing adds a financial burden, so prioritize responsible planning and avoid unnecessary reliance on loans for small expenses.

2. Choose the Right Loan App:

The loan app jungle can be overwhelming! Don’t get tangled in the vines (or high interest rates!). Here’s how to choose wisely:

- Compare loan amounts and repayment terms: Find an app offering the funds you need with a comfortable repayment schedule that fits your budget.

- Interest rates matter. Don’t get blinded by instant access. Scrutinize the APR (Annual Percentage Rate) to understand the true cost of the loan, including interest and fees. Compare rates across different apps to snag the best deal.

- Reputation and Reviews: Check app store reviews and online research to understand user experiences and identify trusted lenders.

- Licensed and Secure: Ensure the app is licensed by the Central Bank of Nigeria and employs secure data practices to protect your personal information.

3. Build good loan habits:

Think of yourself as a credit ninja, cultivating a healthy financial life and boosting your credit score. Here’s how:

- Repay Loans on Time: This golden rule paves the way for better loan terms and lower interest rates in the future. Set reminders and automate payments to avoid late fees and potential credit score dips.

- Borrow Responsibly: Avoid overborrowing beyond your repayment capacity. Remember, loans are tools, not magic money trees.

- Track Your Finances: Maintain a budget and monitor your spending. This awareness empowers you to make informed borrowing decisions and avoid unnecessary debt.

4. Leverage Technology for Better Borrowing:

Many loan apps offer features like budgeting tools, financial literacy resources, and credit score tracking. Embrace these digital helpers to gain deeper insights and make smarter financial decisions.

Remember: Borrowing with loan apps can be a powerful tool for achieving your financial goals. Use this guide as your compass, navigate the landscape with savvy, and unlock the full potential of these digital marvels!

Bonus Tip: Explore apps offering financial incentives like loyalty programs or cashback rewards for timely repayments. Every little bit adds up, strengthening your financial well-being!

So, step into the future of borrowing with confidence! With knowledge, responsible planning, and a smart approach, you can make loan apps your financial allies, propelling you towards a brighter financial future.

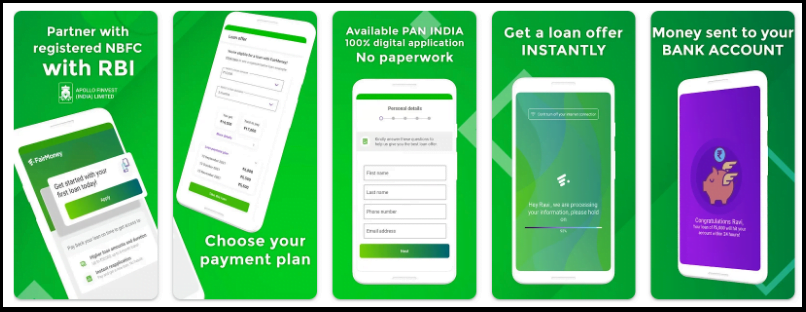

Best Loan Apps In Nigeria

These days, there are no more obstacles in the way of your loan application; you may easily obtain loans from these companies for any purpose you may have. Based on Google Play app installs and ratings, the top digital lending apps in Nigeria are listed here, where you may safely apply for loans.

1. Branch – 10M+ app downloads

4.5⭐/813k reviews

One of the best loan apps available in Nigeria is Branch. With a repayment period of 61-180 days, they offer rapid internet loans and currently have over 10 million downloads. They offer ₦2,000 to ₦500,000 in personal cash loans. Their loans don’t need any paperwork to get; you can get them with the Branch app.

FairMoney MFB – 10M+ app downloads

4.4⭐/478k reviews

With over 10 million downloads, FairMoney is a well-known lending app and among the most popular ones in Nigeria. They are regarded as the preferred app for five-minute loans. They offer SME loans to firms as well. Basic smartphone data and credit history are used to evaluate eligibility for FairMoney affordable loans, which are available to applicants without the requirement for documentation or collateral. Loan amounts from FairMoney start at ₦1,000,000, while their SME loans have a maximum amount of N5,000,000.

ALSO READ: 5 Reasons Why Every Nigerian Needs a Virtual Dollar Card

Alat – 1M+ app downloads

Alat may not be a typical loan app, but it’s worth the mention based on their large range of loan offers. ALAT is Nigeria’s first fully digital bank, designed to help you do more with your money.

Schedule transfers, save and pay bills automatically, take collateral-free loans, get your bank card delivered to you anywhere in Nigeria and save with exciting saving options

It is also worth noting that using my Referral Code: LZ57PE will get 2000 naira worth of Airtime

Kuda – 5M+ app downloads

4.4⭐/164k reviews

Regular customers can apply for short-term loans in the form of overdrafts from Kuda, sometimes known as the “bank of the free.” Their overdrafts have a 0.3% daily interest rate and don’t require any paperwork. Overdrafts usually run for ninety days, however repayments are due thirty days after the money is disbursed.

Quick check – 1M+ app downloads

4.5⭐/147k reviews

Credit ratings and smartphone data are used to approve Quickcheck fast loans. In order to assist their clients in meeting their basic needs until their next paycheck, they provide quick cash.

They are comparatively well-known as a result, and salaried workers primarily use them to fill up the gaps until they receive their paychecks.

RenMoney – 500k+ app downloads

3.3⭐/8.98k

One of the most popular loan financing apps in Nigeria is called Renmoney. Usually, they provide loans up to ₦6,000,000 for a maximum of 730 days. A utility bill, a government ID, and a bank statement are among the prerequisites for their loan.

Aella – 1M+ app downloads

4.4⭐/35.7k

Aella is becoming more and more well-known in the world of internet lending. They have over a million app downloads and are growing steadily. They provide digital loans with competitive interest rates, up to ₦1,000,000, for a period of 1-3 months.

It’s rather simple to obtain a loan in Nigeria now that we have these loan apps. Determining which platform is legitimate and which is fake is the issue. Because of this, there are many misconceptions in the business and customers are unable to distinguish between the truth and lies. We wrote this post for this reason. The Nigerian government and CBN have officially authorized and registered each of the aforementioned applications.

Conclusion: Your Loan App Journey Ends (and Begins) Here

Congratulations! You’ve reached the end (but truly, the beginning) of your journey through the fascinating world of borrowing with loan apps in Nigeria. We hope this guide has equipped you with the knowledge and tools to navigate this dynamic landscape with confidence and savvy.

Remember, borrowing smarter with loan apps is a continuous journey, not a destination. Keep these key takeaways close:

- Prioritize responsible borrowing: Assess your needs, choose wisely, and avoid over-reliance on loans.

- Cultivate smart habits: Repay on time, track your finances, and leverage technology for better financial decisions.

- Stay vigilant: Protect your data, beware of scams, and stay updated on the evolving loan app landscape.

As you move forward, remember that loan apps are powerful tools, but they are not magic solutions. Use them thoughtfully, responsibly, and as stepping stones towards your financial goals.

This guide is just the beginning. Continue your exploration, seek further resources, and build your financial literacy. The power to unlock a brighter financial future lies within your reach. So, step into the world of loan apps with confidence, knowing that you have the knowledge and tools to borrow smarter and safer, one tap at a time.

Remember, we’re all on this journey together. If you have questions, need further guidance, or simply want to share your experiences, keep the conversation going! Let’s continue to empower ourselves and unlock the full potential of loan apps in building a thriving financial future for all.

Onward, and upward!