Piggyvest, a prominent Nigerian fintech platform, has revolutionized saving and investing for millions. However, as with any financial platform, users occasionally encounter concerns. This article addresses common complaints about Piggyvest, offering solutions and highlighting strategies to maximize your savings potential.

Common Complaints about Piggyvest

Here are some frequently mentioned concerns from Piggyvest users:

- Customer support and responsiveness: Some users express frustration with delayed responses or difficulty reaching customer support.

- Security measures and safeguards: Concerns regarding the platform’s security and the safety of user funds sometimes arise.

- Transparency and communication: Occasional lack of clarity regarding specific policies or unclear communication from the platform can cause confusion.

Addressing the Concerns

Piggyvest actively works to address these concerns and continuously improve user experience. Here’s a breakdown of their efforts:

Customer support and responsiveness:

- Piggyvest offers multiple customer support channels, including live chat, email, and social media.

- They strive to respond promptly and efficiently to all inquiries.

- Additionally, they have a comprehensive FAQ section on their website that addresses common user questions.

You can also reach PiggyVest on the following channels:

Email: contact@piggyvest.com

Twitter: @PiggybankNG

Instagram: @PiggybankNG

Contact Number: 0700933933933 or 07009339339

Security measures and safeguards:

- Piggyvest prioritizes user security by employing industry-standard encryption protocols to protect user data and financial information.

- They also partner with reputable financial institutions to ensure secure storage of user funds.

- Piggyvest is regulated by the Securities and Exchange Commission (SEC) of Nigeria, providing an additional layer of security and oversight.

The funds in your PiggyVest Account are warehoused and managed by PV Capital Limited – RC No. 1760152 (“PV Capital”). PV Capital is a duly registered Fund/Portfolio Manager with the Securities and Exchange Commission of Nigeria, and all its operations are in compliance with applicable regulations.

ALSO READ: Is Piggyvest’s Save & Invest Right for You? (2024 Review)

Transparency and communication:

- Piggyvest strives to be transparent in its communication with users.

- They provide clear and concise information on their website, mobile app, and through regular updates on social media.

- They also encourage users to reach out if they have any questions or concerns.

Tips to Maximize Your Savings Potential on Piggyvest

While addressing these concerns, it’s important to remember that Piggyvest offers a variety of features to help you achieve your financial goals. Here are some tips to maximize your savings potential:

Setting clear financial goals:

- The first step is to identify your specific savings goals. Are you saving for a short-term purchase, a long-term investment, or simply building an emergency fund?

- Having clear goals will help you stay motivated and choose the most suitable savings plan on Piggyvest.

Utilizing Piggyvest features:

Piggyvest offers several features designed to help you save more efficiently:

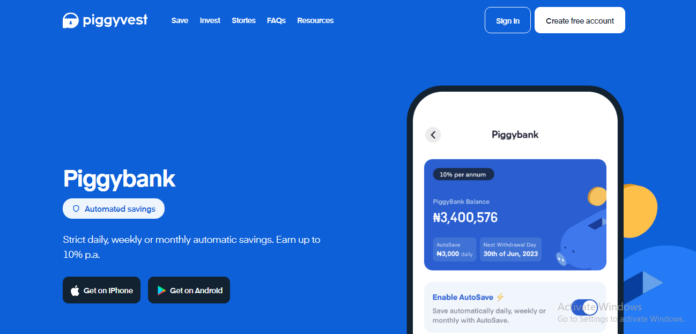

- Autosave: Automate your savings by setting up recurring transfers from your linked bank account. This removes the temptation to spend and ensures consistent saving progress.

- Safelock: Lock away a specific amount of money for a predetermined period. This feature helps you resist the urge to withdraw and reinforces your commitment to your savings goals.

- Target savings: Set a specific savings goal and track your progress towards reaching it. This visual representation of your progress can be highly motivating.

Taking advantage of Piggyvest referral program and bonuses:

Piggyvest offers a referral program where you can earn bonus cash for inviting friends and family to join the platform. Additionally, they occasionally run promotions and offer bonus interest rates on specific savings plans. Utilize these opportunities to boost your savings efforts.

Conclusion – Empowering Your Savings Journey with Piggyvest

Piggyvest acknowledges and addresses user concerns while providing a secure and user-friendly platform to empower your savings journey. By setting clear goals, utilizing the platform’s features, and taking advantage of bonus opportunities, you can maximize your savings potential and achieve your financial objectives. Remember, Piggyvest is a tool, and your success ultimately depends on your commitment and consistent effort. So, start saving today and take control of your financial future with Piggyvest!

FAQ

Do I get interest on PiggyVest?

YES.

- 10% per annum on Piggybank

- Up to 13% per annum on SafeLock

- 9% per annum on Target

- 8% per annum on Flex Naira

- 7% per annum on Flex Dollar

- 11% per annum on HouseMoney

- Up to 25% per annum on Investify

Kindly note that interest rates are subject to change at any time based on market conditions.

What is Target Savings?

With Target Savings, you are able to save consistently towards a particular financial goal. You can create a personal target or a Group savings challenge with multiple users.

Save for your rent, vacation, a new gadget, and even towards starting your new business with Target savings, and earn more money while at it!

How do I activate/create a Target Savings

Log in to your dashboard and click on the ‘Savings’ then select the Target option.

Click on the ‘+‘ option on the bottom right of the page and then select your preferred Target from Personal, Public Group or Private Group.

Input what you wish to save for, select the category, input the amount and fill all required fields to activate it.

Can I break my Target Savings at anytime?

Yes, you can.

Simply log into your dashboard and select the ‘Target Savings’ option on your dashboard. Click on ‘Ongoing Targets’ and then select the target you would like to end and select ‘Break’.

Funds will then be sent to your Flex wallet, and you will be able to access these funds.

However, if you break these funds before the maturity date, you will lose your accrued interest and also be charged a 1% processing fee. If you do not achieve the target amount by the maturity date, you will only lose your accrued interest.

P.S: You cannot break a locked target. Funds can only be accessed at the maturity date. In cases where you may want to close your account completely, you’ll have to wait until your target matures.