Understanding the Danger of Loan Sharks

Loan sharks are illegal lenders who often exploit vulnerable individuals seeking quick financial relief. They operate outside the bounds of the law and typically employ predatory practices that can lead to devastating financial consequences for borrowers. One of the primary characteristics of loan sharks is the exorbitant interest rates they charge, which are significantly higher than those imposed by licensed financial institutions. This predatory approach can trap borrowers in a cycle of debt that is difficult to escape.

Furthermore, loan sharks frequently resort to aggressive tactics to collect debts. Harassment, threats, and intimidation are commonplace, creating an environment of fear for those who borrow from them. This coercive atmosphere not only affects the immediate financial situation of the borrower but can also have long-lasting psychological impacts, leading to increased stress and anxiety. The implications of dealing with loan sharks extend beyond immediate monetary concerns; they may also result in the misuse or mishandling of personal data.

When individuals borrow from loan sharks, they often find themselves providing sensitive personal information without fully understanding how it will be used. The lack of regulation surrounding these illegal lenders means that personal data may be shared or sold without consent, putting individuals at risk of identity theft and further financial exploitation. Thus, understanding one’s rights and the legal ramifications of engaging with loan sharks is crucial. This awareness is the first step in protecting oneself and begins the process of erasing personal data from loan sharks if one has previously engaged in such transactions.

The dangers posed by loan sharks are significant and multifaceted, emphasizing the need for vigilance and education regarding one’s rights in financial transactions. By recognizing the illegal practices associated with these lenders and the potential ramifications of sharing personal data, individuals can better protect themselves from these predatory financial traps.

The Process of Erasing Personal Data

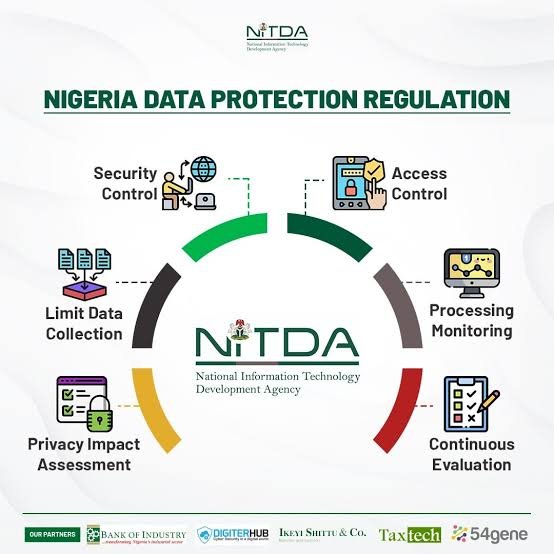

In Nigeria, the process of erasing personal data from loan sharks is anchored in the Nigeria Data Protection Regulation (NDPR), which establishes a legal framework protecting individuals’ personal information. This regulation empowers individuals to request the removal of their data from unauthorized or unethical entities, including loan sharks who often mishandle personal information.

To initiate the process of erasing personal data from loan sharks, the first step is to gather all relevant documentation. This may include loan agreements or any communication that indicates the existence of personal data held by these entities. It is advisable to maintain a chronological record of interactions with the loan shark to substantiate your claims. Documenting dates, methods of communication (such as emails or text messages), and the contents of those communications can be invaluable.

Once you have compiled the necessary documentation, the next step is to formally request the deletion of your data. This can be done by sending a written request to the loan shark, specifying the legal grounds for your request under the NDPR. In your letter, clearly state your intention to have your personal data erased, provide a copy of your identification to verify your identity, and include the relevant details of your relationship with the loan shark.

If the loan shark does not respond to your request within a reasonable time frame or refuses to comply, you can escalate the issue by filing a complaint with relevant regulatory bodies such as the National Information Technology Development Agency (NITDA). Provide all supporting documents, including your initial request and any responses received, as proof of your efforts. This process not only formalizes your complaint but also raises awareness of improper data management practices within the industry.

By ensuring you follow these practical steps, you can take significant measures to safeguard your personal data from loan sharks in Nigeria and promote greater accountability in the financial sector.

Seeking Legal Assistance for Defamation

Individuals who have found themselves targeted by loan sharks and their defamatory practices may consider seeking legal assistance as a viable solution. Defamation occurs when false information is presented as fact, potentially causing harm to an individual’s reputation. In Nigeria, legal recourse for defamation can be sought through the courts, provided that the false statements made by loan sharks meet certain criteria. It is essential for individuals to understand what constitutes defamation in this context to navigate the legal system effectively.

To secure legal representation, it is advisable for affected individuals to consult with lawyers who specialize in defamation and understand the nuances of debt-related issues. A knowledgeable attorney can provide guidance on how to gather evidence of false claims made by loan sharks, helping clients to build a strong case. Documentation of defamatory statements, witness testimonies, and any financial damage incurred can be crucial in substantiating one’s claims in court.

Navigating the court system can be complex, requiring an understanding of both procedural laws and the relevant evidence standards. An experienced lawyer will navigate these legal waters, ensuring that crucial deadlines are met and proper procedures are followed throughout the litigation process. Potential outcomes of pursuing legal action include issuing a public apology by the loan sharks, monetary compensation for damages suffered, or both. Such actions not only provide redress to the victim but can also hinder loan sharks from perpetuating similar defamatory practices against others.

In summary, individuals looking to erase personal data from loan sharks through legal means can benefit significantly from securing legal assistance. By engaging with a skilled lawyer, one can not only aim to rectify personal harm caused by defamation but also discourage unethical practices in the lending industry.

Encouraging Responsible Loan Repayment and Alternative Solutions

Addressing the issue of loan sharks in Nigeria requires a multifaceted approach, with responsible loan repayment serving as a crucial first step toward financial stability. Individuals facing challenges with unauthorized lenders are encouraged to prioritize timely repayment of legitimate loans. This not only helps in building a positive credit history but also fosters responsible financial habits. By doing so, borrowers can strengthen their financial standing and reduce their vulnerability to predatory practices.

Financial literacy plays a fundamental role in empowering individuals to manage their finances effectively. Understanding the principles of budgeting can help borrowers allocate their income wisely, ensuring that they meet their repayment obligations while maintaining a sustainable lifestyle. Educating oneself about interest rates, loan terms, and the true cost of borrowing can significantly reduce the likelihood of falling prey to loan sharks in the future.

Exploring legitimate lending alternatives is another avenue worth considering. Borrowers can research credible financial institutions that offer fair loan products tailored to individual needs. Credit unions and community banks are often more flexible with repayment plans and may offer better interest rates compared to unscrupulous lenders. Furthermore, it is advisable to seek assistance from non-profits and community resources that specialize in debt management. These organizations often provide valuable advice on negotiating with creditors, potentially leading to reduced payments or extended repayment schedules.

Taking proactive steps in managing personal finances can lead to a profound transformation in one’s financial situation. By focusing on responsible repayment practices and utilizing available resources, individuals can regain control of their financial destinies. Ultimately, the goal of erasing personal data from loan sharks must be supported by a commitment to responsible borrowing and a thorough understanding of financial management tools.