Introduction to Personal Loans

Personal loans in Nigeria have become increasingly significant in recent years, serving as a viable financial solution for individuals facing various financial challenges. Primarily, a personal loan is an unsecured loan that allows individuals to borrow money for a variety of personal expenses, such as medical bills, home renovations, educational expenses, or to consolidate existing debts. Unlike secured loans, which require collateral, personal loans typically rely on the borrower’s creditworthiness and income for approval.

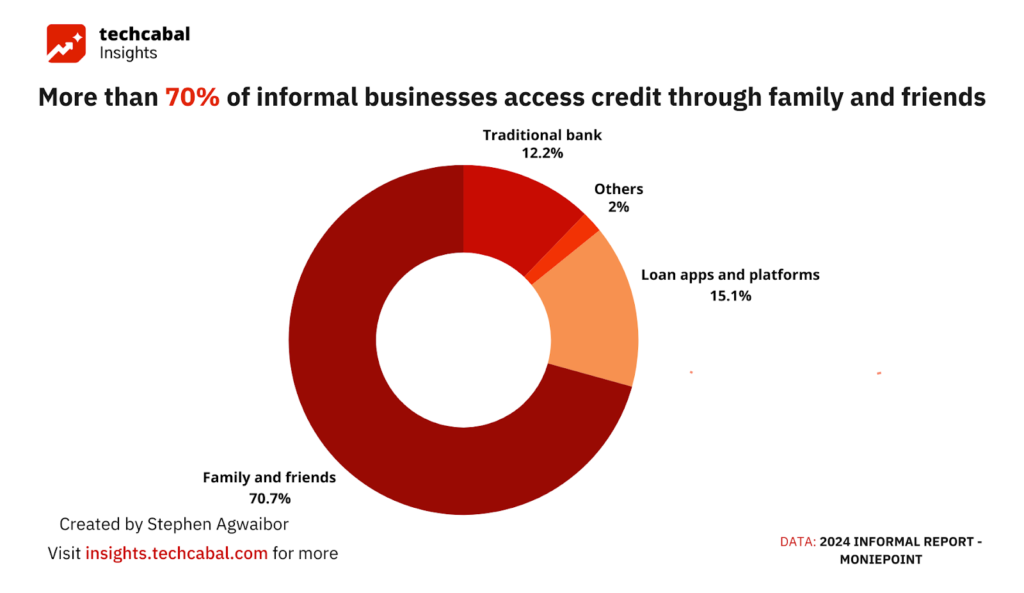

The advent of personal loans has addressed the urgent need for quick and accessible finance options among Nigerians. In a country where financial institutions were historically rigid in their lending processes, the availability of personal loans has provided a more flexible alternative. Borrowers can quickly access funds, often with less stringent qualification requirements compared to traditional bank loans. This flexibility has contributed to their growing popularity, particularly among young professionals and entrepreneurs who require immediate access to cash without the cumbersome application processes of secured loans.

Moreover, the competitive landscape of financial institutions in Nigeria has led to better terms for personal loans, making them an attractive option for individuals seeking financial relief. Many banks and online lending platforms have emerged, offering tailored products that accommodate diverse financial needs. The growth of fintech in the country has further expedited access to personal loans, enabling borrowers to apply and receive funds through mobile apps and online platforms, ensuring convenience and efficiency.

Types of Personal Loans Available in Nigeria

When considering personal loans in Nigeria, it is essential to understand the various types available, as each serves distinct purposes and has unique characteristics. Personal loans can primarily be classified into two categories: secured and unsecured loans.

Secured Loans

Secured personal loans require the borrower to provide collateral, which may include assets such as property or vehicles. This collateral reduces the risk for lenders, usually resulting in lower interest rates. However, the need for collateral can be a drawback for some borrowers, as defaulting on the loan may lead to the loss of the pledged asset. Secured personal loans are commonly used for large purchases or investments where a lower interest rate can significantly reduce overall costs.

Unsecured Loans

Conversely, unsecured personal loans do not require collateral. They are based solely on the borrower’s creditworthiness, making them accessible to a broader audience. Although unsecured personal loans typically come with higher interest rates compared to their secured counterparts, they offer more flexibility as there is no risk of losing assets. These loans cater to a variety of needs, such as home improvements, medical expenses, or consolidating debt.

In addition to the conventional secured and unsecured loans, there are specialized personal loans tailored to specific needs.

Payday Loans

Payday loans, for instance, are short-term loans designed to cover emergency expenses until the borrower’s next paycheck. While they offer quick access to cash, they often come with exorbitant interest rates and can lead to a cycle of debt if not managed carefully.

Student Loans

Student loans also fall under a specialized category, aimed at assisting students in funding their education. These loans generally feature lower interest rates and more flexible repayment options.

Understanding the different types of personal loans in Nigeria empowers borrowers to select the right option that aligns with their financial needs and circumstances. Careful consideration of the features, benefits, and drawbacks of each type will help individuals make informed decisions regarding their personal financing.

Pros and Cons of Personal Loans

Pros

Personal loans in Nigeria can offer distinct advantages for individuals seeking quick financial relief or support for personal projects. One notable benefit is the speed of access to funds. Many lenders provide a straightforward application process that can lead to fund disbursement within a short period, thus enabling borrowers to respond promptly to urgent financial needs, such as medical expenses or home repairs.

Additionally, personal loans offer flexibility in usage. Borrowers can utilize the funds for a variety of purposes, ranging from consolidating debt to funding education or even pursuing personal ventures. This versatility makes personal loans a popular choice among Nigerian consumers looking to navigate financial challenges or investments. Furthermore, compared to other credit options, personal loans in Nigeria often have lower interest rates, particularly for those with good credit history. This can make repayment more manageable, allowing borrowers to avoid overwhelming debt burdens.

Cons

Despite these advantages, it is essential to consider the potential downsides of personal loans. One significant concern is the possibility of high-interest rates, particularly for individuals with less-than-ideal credit scores. This circumstance can lead to a cycle of debt, as borrowers may struggle to keep up with repayments. Additionally, missing payments can adversely affect credit ratings, compounding financial difficulties. Moreover, some lenders may impose hidden charges or fees, which can add to the total cost of borrowing, further complicating financial planning.

It is crucial for potential borrowers in Nigeria to evaluate these pros and cons carefully before proceeding with personal loans. By weighing the benefits against the risks, individuals can make informed financial decisions that align with their needs and circumstances.

Eligibility Criteria for Personal Loans

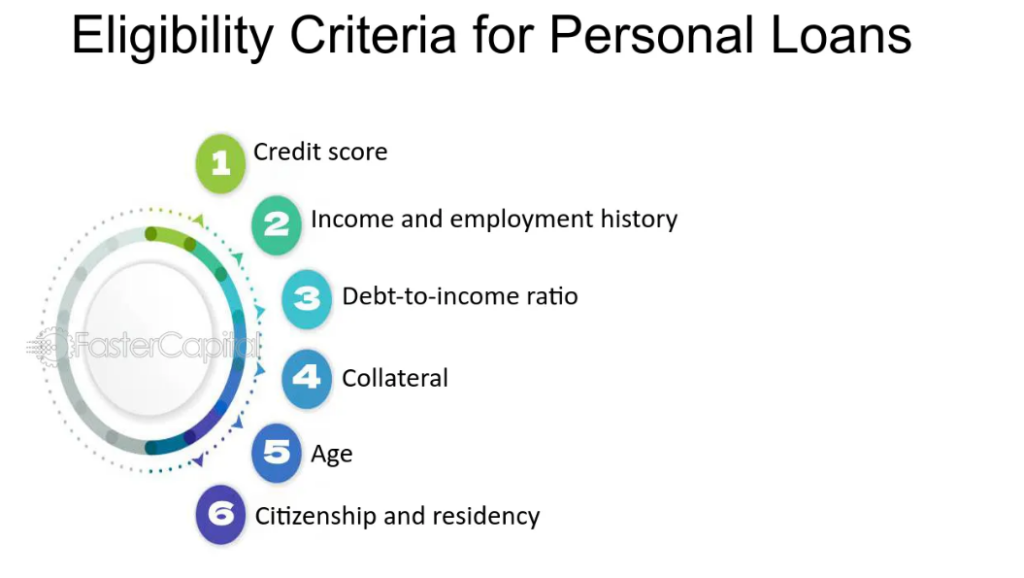

Obtaining a personal loan in Nigeria involves meeting certain eligibility criteria that may vary across different financial institutions. Understanding these requirements is crucial for prospective borrowers who wish to navigate the loan application process successfully. Typically, lenders assess several key factors when determining eligibility.

First, age is a fundamental criterion. Most lenders in Nigeria require applicants to be at least 18 years old, as this is the age of legal adulthood. Additionally, there is often an upper age limit, usually around 60 to 65 years, as older applicants may face concerns related to repayment capacity. Thus, individuals must ensure they fall within this age range to qualify for personal loans.

Another significant factor is income level. Banks and microfinance institutions usually require proof of stable and sufficient income to ensure the applicant can repay the loan. This may involve submitting pay slips, bank statements, and employment verification. For self-employed individuals, lenders may request tax returns or other financial documentation to assess income stability. It is important to note that high, consistent income can enhance the chances of approval and may allow access to loans with better terms.

Credit history also plays a vital role in the evaluation of personal loan applications. Lenders often perform credit checks to assess an applicant’s past borrowing behavior. A strong credit history, characterized by timely repayments and responsible credit use, can provide an advantage. Conversely, poor credit history may result in loan denial or higher interest rates.

Employment status is evaluated, with preference given to applicants with stable jobs or business ventures. Lenders want assurance that borrowers have a reliable source of income to meet their repayment obligations. Understanding these eligibility criteria is essential for making informed decisions when seeking personal loans in Nigeria.

The Personal Loan Application Process

Applying for personal loans in Nigeria involves several steps that demand careful attention to detail. To start, potential borrowers must determine their eligibility for a loan. Most lenders have specific criteria, which may include age, income level, and credit history. Understanding these requirements is essential for a successful application.

Once eligibility is established, the next step is gathering the necessary documentation. Typical requirements include a valid identification document, proof of income such as pay slips or bank statements, and possibly collateral documents if applicable. Some lenders might also request a guarantor, especially if the applicant has a limited credit history. Ensuring that all documents are accurate and up-to-date can enhance the chances of loan approval.

Potential borrowers can apply for personal loans in Nigeria through various methods, including online and offline options. Many banks and financial institutions now offer online applications, providing convenience for applicants. To apply online, individuals need to visit the lender’s official website, fill out the application form, and upload the required documents. Ensuring that the information entered is correct and corresponds with the submitted documents is crucial to avoid delays.

For those opting for more traditional methods, visiting a bank branch or microfinance institution is advisable. Applicants can engage directly with loan officers, who can offer guidance and answer any queries. Meeting with a loan officer also allows applicants to clarify the terms of the loan and any associated fees.

As applicants navigate the personal loan application process, it is beneficial to stay organized and attentive. Following up on the application status and being prompt in responding to any lender requests can help in expediting the process. Preparing thoroughly not only streamlines the loan application but also improves the likelihood of receiving the required personal loans in Nigeria.

Understanding Loan Terms and Conditions

When considering personal loans in Nigeria, it is crucial to grasp the various terms and conditions that accompany these financial products. Understanding these key aspects can significantly influence borrowers’ experiences and decisions.

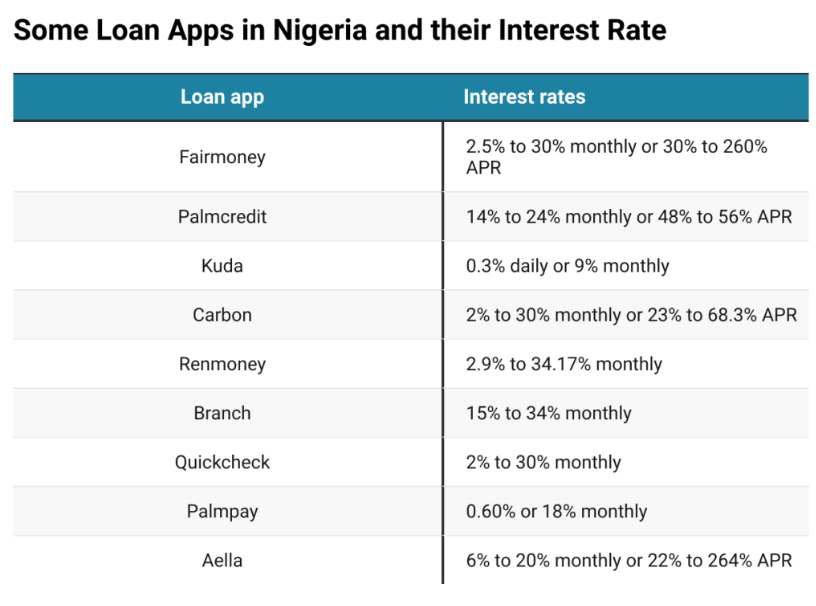

One of the most important components is the interest rate, which represents the cost of borrowing the loan amount. In Nigeria, interest rates for personal loans can vary widely depending on the lender, the applicant’s credit score, and the loan amount. Typically, these rates can be fixed or variable. A fixed interest rate remains unchanged throughout the loan term, while a variable rate may fluctuate based on market conditions. Borrowers should compare different lenders to find the most favorable rates that align with their financial situation.

Another vital aspect is the loan tenure, which refers to the period over which the loan must be repaid. Personal loans in Nigeria usually have a tenure that ranges from a few months to several years. A longer tenure might result in smaller monthly repayments but could lead to a higher total interest cost over the life of the loan. Conversely, a shorter tenure typically incurs less interest but demands larger monthly payments. Therefore, potential borrowers need to choose a tenure that fits their budgeting capabilities and financial goals.

Additionally, fees associated with personal loans, such as processing fees, early repayment charges, and penalties for late payment, can impact the total cost of borrowing. Lenders often impose these fees, and they can vary widely. It is essential to review all fees and conditions before signing any loan agreement to avoid surprise costs that could hinder repayment and worsen financial circumstances.

Understanding the terms and conditions of personal loans in Nigeria, including interest rates, loan tenure, and associated fees, is paramount for any prospective borrower. This knowledge empowers individuals to make informed decisions, fostering financial responsibility and sustainability.

Repayment Options for Personal Loans

The Importance of Emergency Fund: Your Financial Safety Net

Another option is lump sum payments, where the borrower pays the entire loan amount at once, usually upon the maturity of the loan term. This strategy is beneficial for those who anticipate receiving a windfall or significant income influx, such as bonuses or inheritance. However, this repayment method requires careful planning to ensure sufficient funds are available when the payment is due.

Additionally, some lenders offer flexible repayment plans that cater to varying financial situations. These arrangements might include deferment options for borrowers facing temporary financial setbacks. Under such plans, repayments can be postponed or adjusted as necessary, providing borrowers with relief during challenging times. However, it is important to note that while flexible plans may offer short-term benefits, they could also result in increased overall costs due to interest accumulation during the deferment period.

Failing to adhere to repayment schedules can lead to severe consequences. Late payments result in penalties such as additional fees or increased interest rates, potentially complicating the borrower’s financial position. Moreover, defaulting on personal loans in Nigeria can severely impact an individual’s credit score, influencing future borrowing opportunities and financial credibility. Thus, understanding these repayment options and consequences is essential for making an informed decision when applying for personal loans.

Statistical Insights into Personal Loans in Nigeria

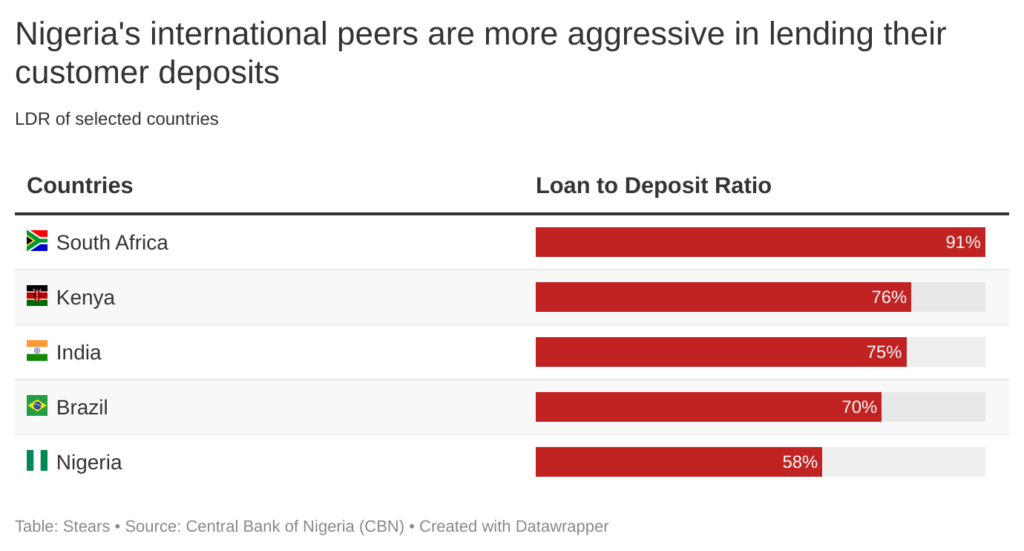

The landscape of personal loans in Nigeria has evolved significantly, influenced by economic conditions and borrower behavior. Recent statistics reveal a notable increase in the uptake of personal loans, with a rise of approximately 25% over the past year. This surge is mainly attributed to the growing awareness of financial products and the need for individuals to access quick cash solutions in an unpredictable economy.

In terms of interest rates, personal loans in Nigeria are averaging between 18% to 30% annually, depending on various factors including the lender’s policies, the borrower’s credit history, and the loan amount. This interest rate structure reflects the dynamic nature of the lending environment and underscores the importance of understanding loan terms before commitment. Borrowers are encouraged to compare offers from different financial institutions to secure the most favorable terms.

Looking at borrower demographics, data indicates that a substantial portion of personal loan applicants are aged between 25 and 40 years. This age group represents a significant market share, as they often seek funds for various personal needs such as education, medical expenses, or starting small businesses. Moreover, a study reveals that approximately 60% of personal loan borrowers are employed individuals, while self-employed individuals account for the remaining share. These statistics emphasize the lending potential among the working population in Nigeria.

However, with the rise in personal loans, there also exists a concern over default rates. Recent reports show that the default rate has climbed to about 7%, which highlights the necessity for borrowers to assess their repayment capabilities thoroughly. Understanding these trends and insights is vital for both lenders and potential borrowers, as it paints a clearer picture of the personal loan landscape in Nigeria.

Best Practices for Managing Personal Loans

Effectively managing personal loans in Nigeria is crucial for maintaining financial stability and ensuring that debt does not overwhelm one’s budget. One of the first steps toward responsible loan management is creating a detailed budget. This budget should encompass all sources of income and account for necessary expenses such as rent, utilities, and groceries. By understanding monthly financial inflows and outflows, borrowers can allocate specific amounts toward their personal loan repayments effectively, minimizing the risk of default.

Timely repayments are another critical aspect of personal loan management. Missing payments can attract penalties and negatively impact one’s credit score, making it difficult to secure future loans. Borrowers should prioritize their loan repayments, possibly setting up reminders or automatic payments to ensure they do not miss deadlines. Additionally, maintaining open communication with the lender can be beneficial. If financial challenges arise, reaching out for advice or discussing potential solutions such as restructuring the loan may provide a viable path forward.

Avoiding debt traps is essential for anyone utilizing personal loans in Nigeria. Borrowers should be wary of taking out multiple loans simultaneously, as this can lead to a cycle of debt that is difficult to escape. It is also important to critically assess the terms of a loan before agreeing, ensuring that the interest rates and repayment conditions are manageable within one’s budget. If circumstances allow, making additional payments toward the principal amount can significantly reduce the overall interest paid and shorten the loan term, resulting in less financial strain.

In summary, managing personal loans effectively involves creating a robust budget, ensuring timely repayments, and actively avoiding debt traps. By adopting these best practices, individuals can maintain control over their financial health and use loans as a tool for growth rather than a burden of debt.