Introduction to FairMoney Loans

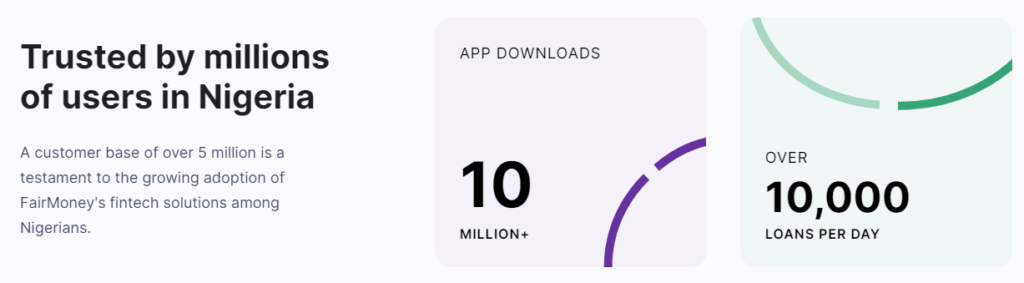

FairMoney is a pioneering digital financial platform in Nigeria, dedicated to bridging the gap in financial accessibility. Founded with the mission to provide accessible and affordable loans to Nigerians, FairMoney has rapidly become a trusted name in the financial services industry. The platform’s innovative use of technology has revolutionized the way loans are applied for and processed, making it significantly easier for individuals to secure fair money loans swiftly and efficiently.

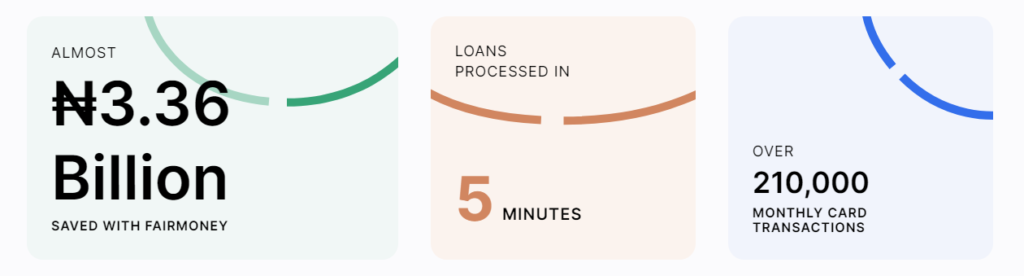

One of the standout features of FairMoney is its streamlined loan application process. Unlike traditional financial institutions that often require extensive paperwork and prolonged approval times, FairMoney leverages advanced algorithms and data analytics to assess loan eligibility within minutes. This technological edge enables the company to offer quick, hassle-free loans to a broad segment of the population, including those who might not have access to conventional banking services.

Beyond just offering loans, FairMoney provides a range of financial services aimed at enhancing the financial well-being of its users. These services include bill payments, airtime purchases, and investment opportunities, all accessible through a user-friendly mobile app. By integrating these services, FairMoney ensures that users can manage their finances comprehensively through a single platform.

In the competitive landscape of financial services in Nigeria, FairMoney stands out due to its commitment to customer-centric solutions and its ability to adapt to the evolving needs of its users. The company’s focus on innovation, affordability, and accessibility underscores its position as a leader in the digital finance space. FairMoney’s approach not only simplifies financial transactions but also empowers Nigerians by providing them with the tools they need to achieve financial stability and growth.

Why FairMoney is the Best Option for Nigerians

FairMoney has established itself as a leading choice for Nigerians seeking financial assistance, and this can be attributed to several compelling reasons. One of the primary advantages of opting for a FairMoney loan is the remarkably low-interest rates. Unlike many traditional lending institutions that impose exorbitant rates, FairMoney ensures that borrowers can manage their loans without facing financial strain.

In addition to low-interest rates, FairMoney offers flexible repayment plans tailored to meet the diverse needs of its users. Whether you are a student, a small business owner, or a salaried employee, you can find a repayment schedule that aligns with your financial situation. This flexibility ensures that borrowers can repay their loans comfortably, minimizing the risk of default.

Another significant benefit of choosing FairMoney is the quick approval times. In an era where time is of the essence, FairMoney stands out by providing swift loan approvals, often within minutes. This rapid processing is particularly beneficial in emergency situations where immediate access to funds is crucial.

Moreover, FairMoney loans do not require collateral, making them an accessible option for a broader audience. The absence of stringent collateral requirements means that more Nigerians can obtain the financial support they need without the burden of securing assets.

Customer testimonials and success stories further underscore the positive impact FairMoney has had on its users. For instance, many small business owners have shared how FairMoney loans have enabled them to expand their operations, purchase inventory, and ultimately increase their revenue. Similarly, individuals have recounted how FairMoney has helped them cover medical expenses, educational fees, and other essential needs, thereby improving their quality of life.

FairMoney’s commitment to financial inclusion is evident in its efforts to support small businesses and individuals. By offering accessible loans with fair terms, FairMoney empowers Nigerians to achieve their financial goals, fostering economic growth and stability. This dedication to inclusivity and support makes FairMoney a trusted and reliable choice for anyone seeking financial assistance in Nigeria.

How to Apply for a FairMoney Loan

Applying for a FairMoney loan is a streamlined and user-friendly process designed to ensure that you receive the funds you need without undue delay. The first step is to download the FairMoney app, which is available on both the Google Play Store and the Apple App Store. Once the app is installed on your smartphone, open it to begin the application process.

Upon opening the app, you’ll be prompted to create an account. This involves providing basic personal information such as your name, phone number, and email address. After entering these details, you’ll need to verify your phone number through an OTP (One-Time Password) sent via SMS. This verification step is crucial for ensuring the security of your account.

Next, you’ll be asked to submit the necessary documentation. This typically includes your Bank Verification Number (BVN), a valid form of identification such as a national ID card or passport, and proof of income. The app’s interface guides you through each of these steps, making it easy to upload the required documents directly from your phone.

Eligibility criteria for a FairMoney loan are straightforward. Applicants must be Nigerian residents aged 18 and above, with a steady source of income. The credit assessment process is quick; FairMoney uses advanced algorithms to analyze your creditworthiness based on your BVN and other financial data. This automated system ensures a fair and impartial assessment.

One of the standout features of the FairMoney app is its user-friendly interface, which makes the entire loan application process quick and hassle-free. From downloading the app to submitting all required information, the process can be completed in just a few minutes. Typically, once your application is approved, funds are disbursed to your bank account within 24 hours, allowing you to access the money you need with minimal delay.

The combination of a straightforward application process, clear eligibility criteria, and fast disbursement makes FairMoney loans a convenient and reliable option for Nigerians in need of quick financial assistance.

Frequently Asked Questions (FAQ) About FairMoney Loans

1. What are the loan amounts available with FairMoney?

FairMoney offers a range of loan amounts to cater to various financial needs. Borrowers can access loans starting from as low as ₦1,500 up to ₦1,000,000. The specific amount you are eligible for depends on your creditworthiness and financial profile.

2. What interest rates are applied to FairMoney loans?

The interest rates for FairMoney loans are competitive and vary based on the loan amount and repayment term. Generally, the interest rates range from 10% to 30% per month. It is advisable to review the terms and conditions on the FairMoney app to get precise interest rate details for your specific loan offer.

3. How are repayment schedules structured for FairMoney loans?

Repayment schedules for FairMoney loans are flexible, designed to accommodate the borrower’s financial situation. Typically, repayment periods range from 4 weeks to 26 weeks. The exact duration will be specified in your loan agreement, allowing you to plan your repayments accordingly.

4. What are the penalties for late payments?

FairMoney understands that circumstances can change, leading to delays in repayment. However, late payments do incur penalties to encourage timely repayments. The penalty structure includes additional interest charges based on the overdue amount. It is crucial to make timely payments to avoid accruing extra costs.

5. Is it possible to extend the loan term?

Yes, FairMoney provides an option to extend the loan term if you are unable to meet the original repayment schedule. To request an extension, contact FairMoney customer service through the app. The request will be evaluated based on your repayment history and current financial situation, and an extended term may be granted with adjusted terms and conditions.

These frequently asked questions aim to offer clarity and confidence for potential borrowers considering a FairMoney loan. By understanding the loan amounts, interest rates, repayment schedules, and options for extending terms, borrowers can make informed decisions and manage their finances effectively.